As the saga of the recent $69 billion acquisition of VMware by Broadcom continues to play out, it has sent shockwaves through the tech industry. As I look around and watch the dust starting to settle, it’s clear that VMware’s extensive user base – hundreds of thousands of customers worldwide – has been left with uncertainty and difficult decisions ahead. It’s actually a little hard to watch.

A majority of VMware partners and customers are coming to a stark realization: the future they planned for with VMware will likely look vastly different under Broadcom’s leadership.

The tectonic shifts began late 2023 when the first signs of change emerged. VMware announced updated subscription packaging, bundling previously standalone products like Cloud Foundation and Tanzu into a single paid offering. For loyal customers relying on these solutions, this signals a pivot toward financial motivations over customer-centric values, which leaves IT leaders at an uncertain crossroads as they ask “What’s next for my hybrid cloud strategy?”

I’d like to use this blog to explore the developments to VMware’s Software-Defined Data Center portfolio head-on. I’ll offer some analysis of the new VMware Cloud Foundation subscription model and try to guide you through your most likely available go-forward options.

The VMware we all knew may be gone – but your ability to adapt and thrive through disruption remains.

Updated VMware Cloud Foundation Packages

VMware’s recent announcement on packaging updates introduces significant changes to its product offerings and licensing model that are raising customer concerns. The updated packaging includes:

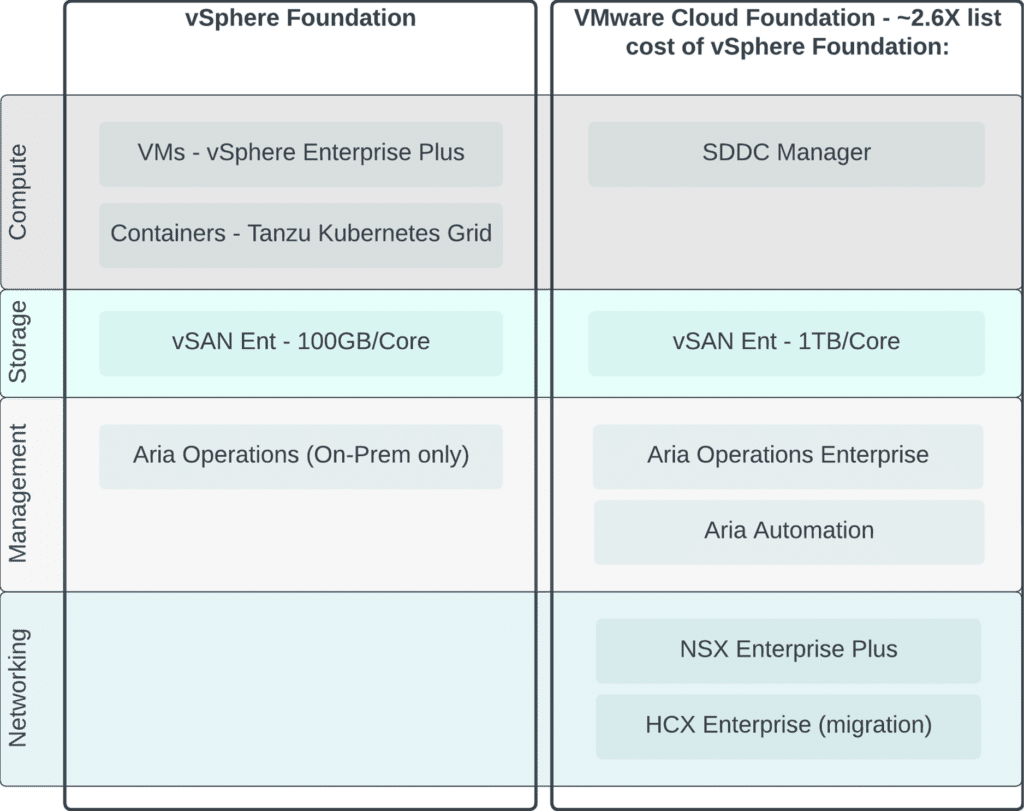

- VMware Cloud Foundation: This umbrella option requires paying for every VMware solution involved in creating a fully virtualized data center, encompassing Compute, Network, and Storage capabilities on physical hardware. It also includes solutions for monitoring and automation.

- VMware vSphere Foundation: Aimed at those starting with Compute Virtualization, this package offers VMware Enterprise + licensing, limited Tanzu and vSAN features, and operational monitoring for private cloud workloads.

The shift towards an exclusive subscription-based licensing model marks a considerable change in VMware’s approach. Historically, CapEx-focused organizations have preferred perpetual licensing for its one-time purchase appeal, accommodating easier budgeting for long-term software use without needing annual allocations. This transition could unsettle customers who invested in perpetual licenses expecting lifetime support and predictable costs. Instead, they may encounter unexpected expenses during renewal periods, as the subscription model could lead to increased costs.

Customer Options

Navigating the updated VMware Cloud Foundation licensing landscape presents distinct paths for customers, each with its implications for cost, utility, and strategic alignment. Here’s a breakdown of the key considerations:

Option 1 – Sticking with VMware Cloud Foundation Licensing

Mainly for those organizations already invested in and satisfied with the VMware Cloud Foundation suite. Maintaining this path might offer temporary cost benefits if your operations are deeply integrated with VMware’s ecosystem and require a significant portion of the included products.

However, feedback suggests that a one-size-fits-all VMware solution is rare. Many organizations blend VMware products with third-party or in-house solutions, reducing the reliance on a comprehensive VMware suite.

Challenges with Full VMware Suite Adoption

- Diverse Needs: The trend leans towards selecting specific VMware solutions while integrating external technologies. This tailored approach often aligns better with strategic goals than adopting the entire VMware suite.

- Pressure from VMware: Customers report VMware’s aggressive push towards adopting a broader range of products, which may not fit every organization’s technology strategy or needs.

Convoluted Decisions for Partial Suite Users

- Cost Implications: For those not utilizing the full VMware Cloud Foundation suite but needing certain components, transitioning to the VMware Cloud Foundation licensing could lead to a significant cost increase—approximately 2.6 times higher than the base vSphere Foundation package. This price surge could be prohibitive, particularly for large environments.

- Evaluating Value: The critical question becomes whether the additional expense is justified by the value received. If many components remain unused (“shelfware”), the investment may not be worthwhile.

Option 2 – Reduce Licensing to vSphere Foundation

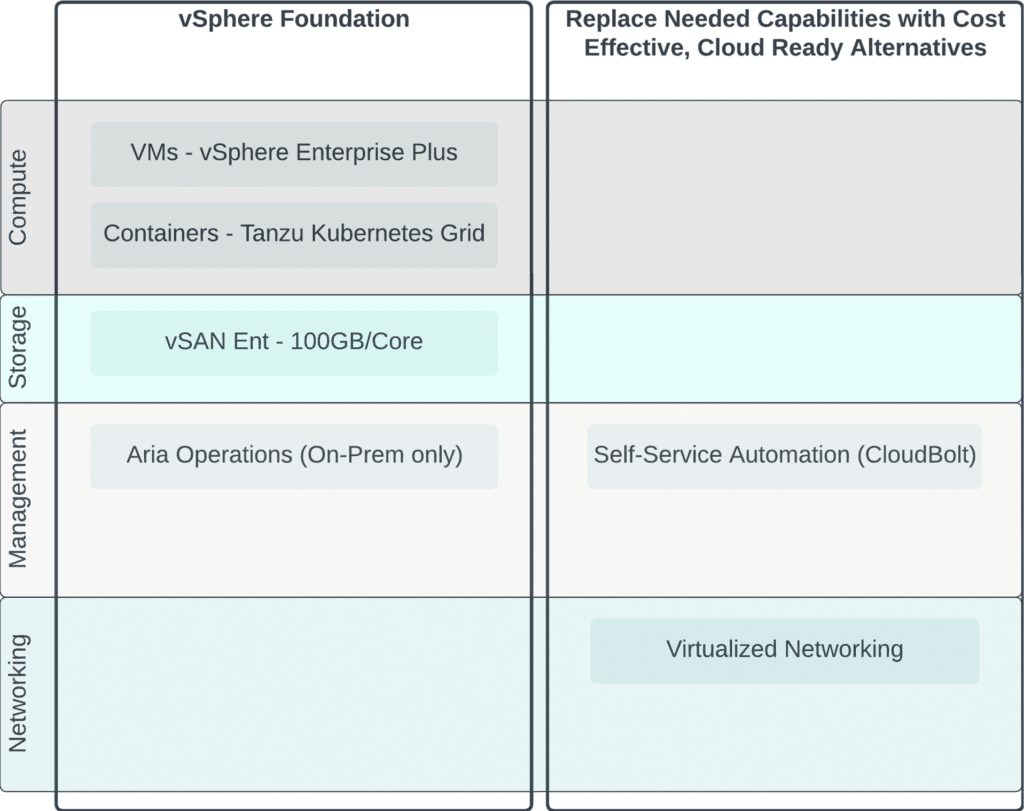

I hear more customers and partners leaning toward this in these early conversations. This entails replacing the set of required capabilities from the VMware Cloud Foundation package with more cost-effective (and often more public cloud-interoperable) options while sticking with vSphere Foundation to handle your compute and storage virtualization and operational monitoring of vSphere workloads.

Primary Benefits:

- Maximize existing investments in technical skill sets: By continuing to leverage the base VMware capabilities for vSphere and Aria Operations you are able to These are still best-of-breed solutions for datacenter-based workloads, and most organizations invested in the VMware ecosystem have a lot of in-house expertise for these systems.

- Cost Reduction/Avoidance: By leveraging more cost-effective options at different layers of the stack, VMware customers are able to reduce costs and avoid the Broadcom tax.

- Increased interoperability across the hybrid cloud: This approach really allows your organization the freedom of choice. VMware only supports VMware workloads in the datacenter; investing in best-of-breed, vendor-agnostic alternatives of VMware in other layers of the stack allows you to pivot to different alternatives in the future should the business require it. This also allows you to take advantage of tool sets that are more public cloud-friendly.

- Vendor lock-in avoidance: I’ve heard the all-in on VMware approach described as a “single throat to choke” when addressing support issues across their product stack. In reality, my experience with this approach has been anything but easy. They are still a very large business that is highly siloed among their products, and communications across support teams often break down (in my personal experience).

Risks to this approach:

- Migration to new systems takes time, and ramp up for technical resources.

- vSphere Foundation Licensing may still be cost ineffective for your organization.

Option 3 – Remain in Datacenter – Replace VMware Stack

Options 3 and 4 are for customers who have determined that they need to get away from Broadcom, no matter the cost. Some of these customers opt to keep at least some of their workloads in the data center (Option 3). In contrast, others may opt to use this as an opportunity to divest away from data centers altogether (Option 4).

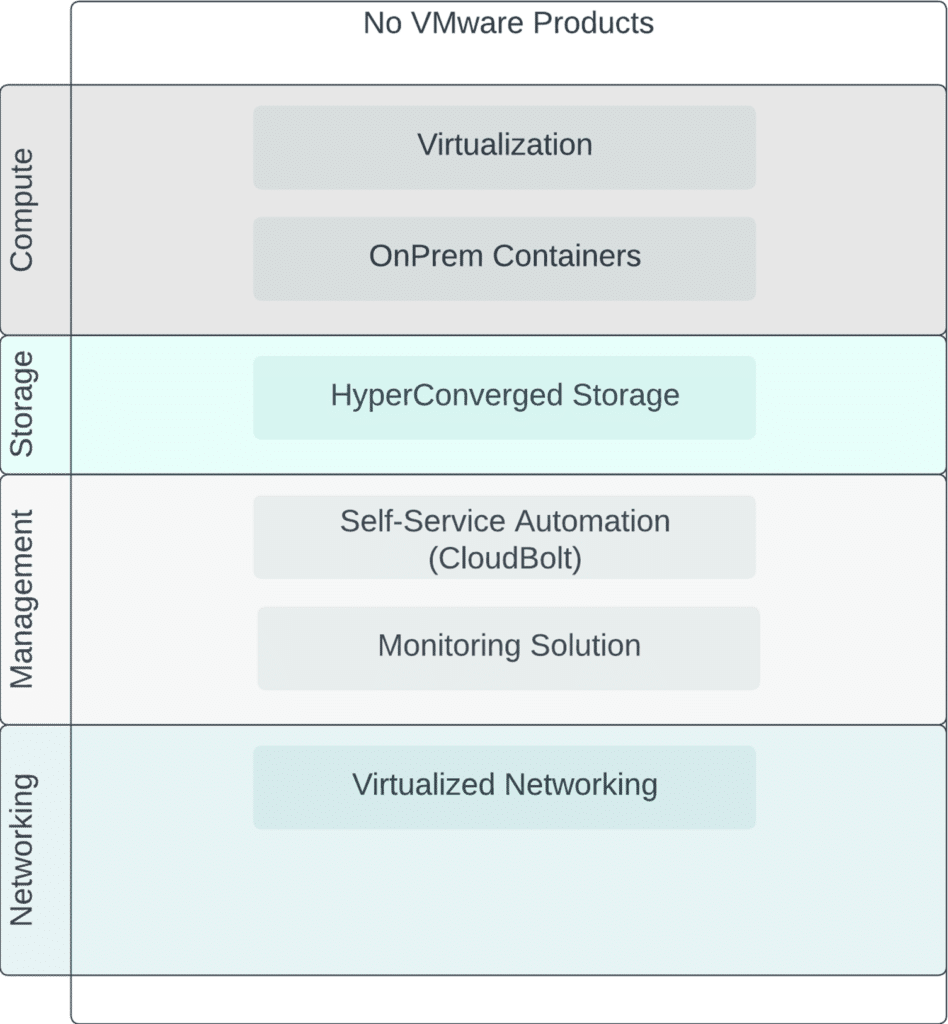

For customers looking to stay in the data center but switch out the underlying technologies, this is a fairly large undertaking, depending on your existing footprint. This could involve switching out VMware products to VMware alternatives at multiple layers of your stack and ensuring that your new product stack is completely interoperable.

By the way – if your approach starts with Option 2 – where you adopt, say, CloudBolt *shameless plug (but hey, it truly is the right answer here)* – if you choose to mature to either Option 3 or 4 down the road, your self-service layer goes with you, and can help drive interoperability between some of these systems.

Benefits:

- Leverage existing investments in the datacenter

- Start to shift some workloads to the public cloud

Risks:

- Large migration

- Skills gap on new technologies

Option 4 – Go Cloud Native

For those considering a full exit from their data centers in response to Broadcom’s VMware acquisition, shifting to cloud-native architectures may represent an appealing strategy. Adopting microservices, containers, serverless platforms, and other cloud-native technologies promises increased agility, scalability, and innovation velocity compared to legacy environments.

However, be warned that the path to realizing this vision will take longer than you might expect. Truly re-architecting applications and transforming operational practices to leverage cloud-native’s full benefits involves deep technical and cultural changes within an organization. The journey requires significant financial investment, retraining staff, refactoring code, and likely replacing some legacy systems completely.

For many enterprises, this level of transformation will not feasibly align with business priorities and realities in the near term. The hybrid cloud path provides a practical middle ground. With a hybrid cloud, organizations can modernize legacy systems incrementally while also leveraging cloud platforms for greenfield development. This balanced approach allows enterprises to gain some cloud-native advantages while ensuring continuity of critical business operations.

Conclusion

As VMware customers face difficult decisions in the wake of Broadcom’s acquisition, I empathize with the uncertainty many are feeling. Transitioning business-critical systems brings risk, cost, and complexity that technology leaders must weigh carefully. This is an unsettling time and presents opportunities to reevaluate technology strategies for years to come. Avoid decision paralysis, but take the time needed to analyze options carefully.

Ultimately, the right choice depends on individual requirements, long-term goals, and the willingness to navigate the complexities of the transition. As customers evaluate their options and alternatives of VMware, carefully considering costs, interoperability, and the desired strategic direction will be crucial in determining the most suitable path forward in the post-acquisition landscape.

At CloudBolt, we aim to be a trusted partner for organizations navigating this transition. Our vendor-neutral orchestration platform offers flexibility to integrate both VMware and third-party solutions/alternatives of VMware, aligning with diverse needs. For those seeking alternatives, we facilitate smooth migration from VMware technologies to our solutions. If now is the time to talk more, feel free to reach out for an open dialogue on how to move forward thoughtfully, which sets your organization up for long-term success.

Click here to learn how CloudBolt can help you navigate the VMware acquisition.

On Tuesday, December 10, we delivered two sessions of a webinar focusing on the “Top vRA8 Deployment Considerations”. Here is the recap of the webinar and all our supporting content, including the full recording of the first session. Each session ended with about 20 minutes of Q&A from the audience. Below, are all the questions and answers from both webinar sessions.

Although you may not be ready to make the move to vRealize Automation 8 just yet, it’s time to start planning. Time to start unraveling all the customizations and integrations that make your vRealize Automation 7 environment perform it’s magic. If you’re like most vRA7 users, it is a combination of third party integrations, open source customizations, home grown customizations, and scripts joined together around your specific business process that makes the automation magic happen.